How To Transfer Money From Sofi To Cash App

Advertiser Disclosure: Most products in our articles are from partners who may provide us with compensation. Still, opinions expressed here are writer's lonely, not those of any banking company, credit card issuer, airline or hotel concatenation. This page may include information nearly American Limited products currently unavailable on Slickdeals. American Express is non a partner of Slickdeals.

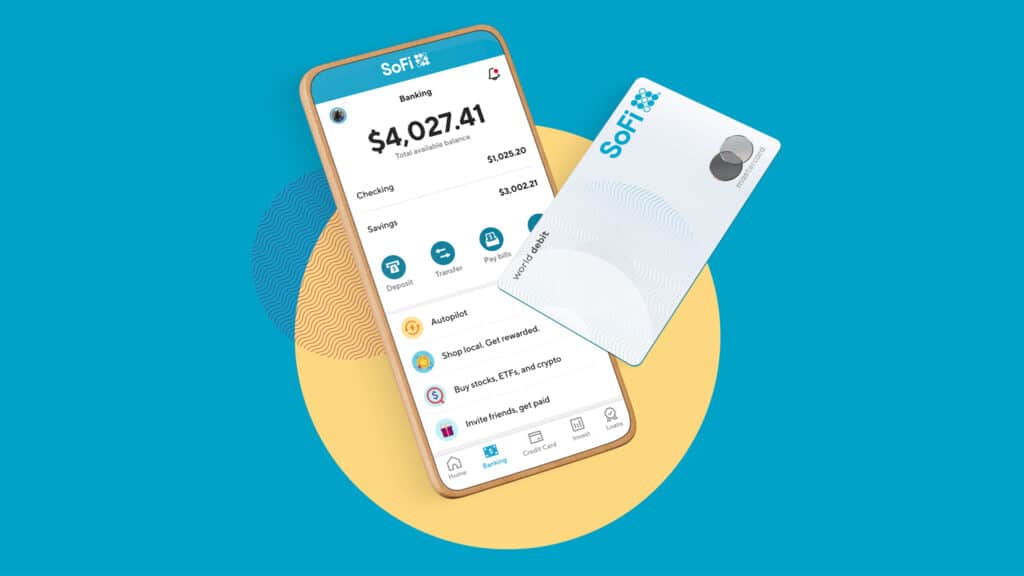

Meet SoFi Checking and Savings. The fiscal institution's newest money management tool is much like other deposit accounts, except with one large benefit — yous tin earn up to 3.50% APY on your savings balances, also as up to ii.50% APY on checking balances.

Also unlike accounts from other banks, you won't have to jump through a lot of hoops to earn that elevated ii.50% – 3.l% APY. All y'all have to practise is prepare upwardly monthly directly deposits of your paycheck or government-issued benefits. Y'all won't even have to receive a minimum direct deposit amount to earn that the increased APY.

What'southward more, new customers tin currently earn a sign-up bonus worth up to $250, simply for opening a new Sofi Checking and Savings account and receiving qualifying direct deposits.

Read more to find out if signing upwardly for a new account is right for y'all.

Offer Details

Secure application on issuer'southward website.

Bonus: Up to $250 ⓘ $250 bonus for opening a new SoFi Checking and Savings business relationship and receiving a full of $5,000+ in qualifying direct deposits within the specified evaluation period.

Monthly Fees: None

Minimum Opening Balance: None

Features:

Earn up to 3.l% APY (monthly direct eolith required) ⓘ With monthly direct deposit, customers earn 3.50% APY on savings balances, every bit well as two.l% APY on checking balances.

Get paid upward to two days early

No minimum monthly balance

No maintenance fees, non-sufficient fund fees or overdraft fees

Access to 55,000 ATMs worldwide through the Allpoint Network

FDIC insured

Beyond the sign-up bonuses, though, SoFi Checking and Savings has a lot to offer. Y'all'll get a few big perks including the run a risk to earn up to 3.50% APY, no business relationship fees, getting paid upwards to ii days early and automatic savings features to help yous reach your financial goals.

Quick Navigation

SoFi Savings and Checking Bonus: $250

It's pretty common present for banks and brokers to offer a welcome bonus when you sign up and run across sure requirements, and the SoFi Savings and Checking account is no different.

New customers tin currently earn a i-time bonus of up to $250 when they open a new SoFi Checking and Savings Account before Jan 31, 2023. Here's how the sign-up bonuses piece of work.

To qualify for the bonus, you must open a new SoFi Checking and Savings Account and receive at least $1,000 in qualifying direct deposits inside a 25 mean solar day "Evaluation Flow" which begins the day your beginning qualifying directly deposit is received. Hitting the minimum requirement will net you a $fifty cash bonus, with one boosted bonus tier achievable:

| Total Qualifying Directly Deposits: $i,000 – $4,999 | Cash Bonus: $50 |

| Full Qualifying Direct Deposits: $v,000+ | Cash Bonus: $250 |

Once you meet the direct deposit requirement, you'll receive your welcome bonus money within two weeks.

SoFi defines qualifying direct deposits as transactions made from an enrolled member'due south employer, payroll or benefits provider via ACH deposit.

While we've seen larger bonuses tied to this account in the past – a SoFi $300 bonus was available for much of 2022, for example – the interest rates of savings balances are higher than they were during previous promotions, which helps make up for the slightly lower cash payout.

SoFi Directly Deposit Bonus Fine Print

To be eligible for the SoFi Checking and Savings bonus, yous'll need to open an account by January 31, 2023.

The deposit must come from your employer, payroll or benefits provider — such as a paycheck or government-issued benefits bank check. Transfers from Venmo, PayPal and similar peer-to-peer payment services don't count, and neither do ACH transfers from other bank accounts that don't vest to your employer.

Additionally, one of import thing to keep in mind with this welcome bonus is that it's considered miscellaneous income for revenue enhancement purposes. This means you lot may receive a form 1099-MISC (or Form 1042-S, if applicative) in the post at the first of tax season, and you'll need to claim that income on your revenue enhancement render. Notwithstanding, this is a common occurrence with bank business relationship and broker bonuses, and the value of the bonus far outweighs the tax bill.

SoFi Checking and Savings Referral Bonus: $25

Once you become a SoFi member, using its mobile app, you lot can send referral links to friends or family members to likewise open an account. If they use your unique referral link to open an account, then fund information technology with $ten or more via qualifyings transfers within 5 days of registration, both you and the person you referred will receive a referral bonus of $25.

SoFi encourages members to send referral links to friends, colleagues, family members and anyone else you think may exist interested in opening an account.

How to get the referral bonus

Here's how to get credit for your referral links and earn a referral bonus. Using the SoFi app, log into your account to admission your own unique referral link and and then do the following:

- Look for the "Invite friends" button (or tile) on your SoFi Checking and Savings habitation screen.

- Click on the push button to generate referral links for friends via a pre-populated SMS, email or social media.

Terms and weather apply.

SoFi Promo Codes

No SoFi promo codes are necessary to claim any of the new account bonuses yous'll find on this article. Simply follow the steps to a higher place, and you volition receive your bonus — no promo code needed!

What Is SoFi Checking and Savings?

Upward until recently, SoFi was not officially a bank — although client deposits were FDIC insured.

However, in 2022, SoFi became an online bank and, every bit such, was able to offer its new and current clients traditional banking products.

And then if you opened a SoFi Money account prior to the house'south incorporation as a bank, don't worry — y'all'll keep all of your benefits until your spending account is converted to the new Checking and Savings product.

Currently, SoFi is withal an online-simply bank. But who knows, perchance yous'll come across a brick-and-mortar location in your neighborhood one twenty-four hours.

Earn up to 3.50% APY

SoFi Checking and Savings isn't a loftier-yield savings business relationship, but it offers a much higher almanac percentage yield (APY) on your deposits than the vast bulk of checking and likewise many savings accounts on the market.

How to earn 2.l% – three.50% APY involvement rate

The merely requirement to earn increased interest is that you lot ready a recurring monthly direct deposit of your paycheck or benefits provider via ACH deposit. There's non a minimum direct eolith, either. And so regardless if y'all go a $100 direct eolith from your employer each month or $4,000 in direct deposits — you'll earn 2.50% APY on your checking balances, as well equally iii.50% APY on your savings.

While y'all'll earn a higher interest charge per unit on your savings balance than your checking balance with this offer, ii.l% APY for checking is all the same strong plenty to compete with the best loftier-yield checking offers.

Keep in mind that deposits that are not from an employer like checks, P2P transfers from PayPal, Venmo or others won't count.

What APY exercise you earn if you don't have a direct deposit?

If yous don't meet the directly deposit requirements, though, your APY will nonetheless exist a healthy ane.20% APY, which is however higher than rates offered by many other banks.

But if SoFi is your principal account and you can easily meet the straight deposit requirement, you won't take any problems.

SoFi Checking and Savings Work Together

If you lot're wondering if you can but open a checking or merely a savings, the SoFi Checking and Savings comes equally a package deal. The good news is that both accounts characteristic the aforementioned requirement to earn elevated interest; once you fix recurring directly deposits, you'll earn ii.l% APY on checking balances and 3.l% APY on your savings.

No Business relationship Fees

With SoFi, you'll never need to worry about overdraft fees, monthly fees or punitive fees considering you didn't meet a minimum balance requirement.

Plus, yous'll take fee-free access to the Allpoint ATM network which operates 55,000 cash points nationwide. Still, if you use a not-network ATM, you volition incur third-party fees.

Go Paid upwardly to Two Days Early

When y'all set upward direct deposit, you'll recieve your paycheck up to ii days earlier.

This early-access feature is based on the timing in which SoFi receives discover of impending payment from your employer or depositor. This is typically upwards to two days before the scheduled payment date, but your mileage may vary.

SoFi Checking and Savings Rewards

Following the Great Recession, the Federal Reserve capped debit carte du jour interchange fees at the bidding of Congress, and debit cards with rewards became a dying brood. Only recently, they've started making a comeback, especially as online banks and brokers accept grown with their lower overhead costs.

SoFi Checking and Savings offers one of these accounts, and its debit card offers upwards to 15% cash dorsum with select businesses.

When yous check your SoFi app, you'll be able to view various offers for up to 15% back from local retailers and businesses. This gives y'all a adventure to support local businesses and get a piffling something back in return.

Depending on how you spend your coin, y'all may not be able to have advantage of all of these rewards offers. Only if your alternative is a checking account at another banking company with no rewards at all. It's like shooting fish in a barrel to run across that SoFi has an reward.

Other Benefits

Greenbacks-dorsum reward offers, a high APY and bonus offers may be enough for a lot of people to selection SoFi over other banking alternatives. Just if yous want more, the business relationship provides more. Hither are some of the other features you lot tin await forwards to with this hybrid checking-savings account:

- Vaults:SoFi Savings Vaults are extensions of your account, where you tin can earmark funds for certain goals. You tin create upwards to 20 Vaults, and there are no fees or minimum balance requirements.

- Roundups:With the Roundups feature, every purchase you make with your debit carte volition be rounded upwardly to the nearest whole dollar. Then the deviation will be automatically transferred to ane of your Vaults, which you can dedicate for that savings. Saving a few cents every fourth dimension you swipe your bill of fare may not sound similar a lot, but it can add together up over time.

- Money transfers:The app allows you to transfer money to anyone you want, similar to Venmo or Cash App. If they're a SoFi member, they'll receive the funds instantly. If not, they'll receive the cash within two to three business days after they submit their bank business relationship information to become the funds.

- Mobile deposit:While yous can't deposit cash into a SoFi business relationship super hands, you tin can deposit checks via the mobile app.

- No ATM fees: Withdrawing cash is fee-free. No ATM fees if you utilize one of the more than 55,000 ATMs worldwide in the Allpoint network.

Fees

Some other benefit of having a SoFi Checking and Savings is that yous don't have to worry nearly account fees, which are what banks and credit unions may choose to charge on all accounts to maintain them. This primarily includes a monthly servicing fee. At that place are also no ATM fees if you use one of the more than 55,000 ATMs worldwide in the Allpoint network.

That doesn't hateful SoFi Checking and Savings is completely fee-free, though. If you use an out-of-network ATM, for case, you'll be charged a fee past the ATM owner, and SoFi won't reimburse that fee like some other online banks do.

There'due south as well a foreign currency conversion fee of 0.2%, which you'll be charged if you apply your debit bill of fare to brand a buy or ATM withdrawal in a foreign currency.

How to Maximize SoFi Checking and Savings

SoFi Checking and Savings offers a lot of features that yous tin't get with a traditional checking or savings account. And considering it'southward partnered with SoFi Invest, it makes information technology easier to transfer funds between its banking and investment accounts, if that's something you desire to do. Read our full SoFi Invest review to learn more.

To maximize the value you lot tin go from SoFi Checking and Savings, here are some things you tin do:

- Read the fine print on the sign-up bonus to brand certain you receive the full amount.

- Encounter the monthly directly deposit requirement to qualify for the higher APY and cash-back rewards.

- Check your mobile app regularly for the latest limited-time cash-back offers.

- Take advantage of your Vaults to plant and rails dissimilar savings goals.

- Plough on the Roundup characteristic, so you can salvage every fourth dimension you use your debit bill of fare.

With the cash-back offers, information technology's besides important to know when non to take reward of an offer. In general, if you lot would've spent the money with or without the rewards, activate the offer and get your rewards. But if you're spending money y'all wouldn't normally spend just to earn ten% or 15% dorsum, yous're losing more than you're gaining.

SoFi Credit Menu

SoFi also offers a credit card that pairs well with its Checking and Savings business relationship. The SoFi credit bill of fare offers flat-rate 2% unlimited greenbacks back for everyday spending. The credit card awards i% cash back on all eligible purchases — and when you lot redeem rewards to pay down eligible debt, transfer to your SoFi Checking and Savings or SoFi Invest account, it awards an extra one%, for a full of 2%.

Furthermore, when you lot make 12 on-time payments, the April on any remaining credit card balance is lowered by 1%. This is a lot of value for a credit card with no annual fee.

SoFi Invest

SoFi Invest provides a lot of different options for investors, including active investing, an automated robo-advisor, retirement accounts, cryptocurrency and even fractional shares. This account occasionally features a bonus for new members or a promotion to win free stock.

SoFi'due south Agile Investing platform helps you lot brand that happen. You tin can buy stocks and substitution-traded funds (ETFs). At that place's no account minimum, which means y'all can get-go with as trivial as $1, making it perfect for brand-new investors without high net worths.

Unlike many robo-advisors that charge an almanac fee to manage your investment account, SoFi'southward Automated Investing program charges no business relationship management fees at all. That's right, you can opt to have your investments managed for you and pay no annual fee.

SoFi Invest also offers cryptocurrency trading. What'south more, you can trade crypto directly in the SoFi app, which ways you don't have to keep track of complicated cryptocurrency wallet passwords.

SoFi Loans

SoFi Loans offers a variety of personal loans for abode comeback, credit card consolidation, medical procedures and relocation assistance. It also offers loans for abode owners including mortgages and mortgage refinancing.

Student Loan Refinancing

In addition to individual pupil loans undergraduate and graduate student loans and parent student loans, you can besides refinance your student loans. Refinancing is a great solution for working graduates who have loftier-interest, unsubsidized Straight Loans, Graduate PLUS loans and/or private loans. Federal loans do carry some special benefits similar public service forgiveness and economic hardship programs, which may not exist accessible to yous later you refinance.

Opening a SoFi Account

SoFi isn't right for everyone. If you like in-person service or deal with a lot of greenbacks, using SoFi may be more trouble than it's worth. But if y'all don't apply cash regularly and prefer an online banking setup, it'due south one of the amend banking options out in that location. Plus, the bonus for new account holders gives y'all a nifty alibi to test bulldoze membership.

That said, take some fourth dimension to compare SoFi Checking and Savings with loftier-yield checking and savings accounts, and compare rates and other features to detect the right fit for y'all.

Oftentimes Asked Questions:

What is SoFi Checking and Savings?

SoFi Checking and Savings is a deposit account offered past SoFi. SoFi Checking and Savings extends account holders up to 3.50% APY on their balances, no monthly fees or overdraft fees, gratis ATM admission via the Allpoint network, and a mobile app.

How practise I earn the SoFi Checking and Savings Referral Bonus?

Friends and family can earn the SoFi Checking and Savings referral bonus by successfully opening a new account and making a eolith of $ten or more than within 5 days of account opening. The deposit must be made via an ACH transfer or via "Instant Transfer" from a debit carte du jour — Venmo, PayPal, Apple Cash, and other P2P transfer platforms are ineligible to earn the referral bonus. Additionally, SoFi Checking and Savings referral bonuses are not bachelor to residents of Vermont and Ohio or SoFi employees.

How does the SoFi Checking and Savings Circular-upwardly Bonus piece of work?

When SoFi Checking and Savings account holders set up a Vault, whatsoever purchases made with a SoFi debit carte are automatically rounded upwards to the nearest dollar and deposited into the Vault. For example, if you lot spend $2.50 on a cup of coffee, SoFi debits your account $3 and deposits the extra $0.50 into your Vault. Periodically, SoFi will offering round-up bonuses where members tin can earn an additional bonus cash but for using the round-up characteristic.

Should I consider the SoFi Credit Card?

You should consider the SoFi Credit Card if you prioritize greenbacks-dorsum rewards for your approaching spending over travel rewards, and if you are a SoFi member or willing to go one. The Sofi Credit Menu carries no annual fee, and information technology offers two% cash back (earned as points) on all eligible purchases.You tin redeem your points to pay downwards your SoFi Credit Card balance or eolith them into a SoFi Checking and Savings or SoFi Invest account for cash dorsum.

More than Almost Current Banking company Bonuses:

Featured photo courtesy of SoFi

While we work difficult on our research, nosotros do not e'er provide a complete list of all available offers from credit-card companies and banks. And considering offers tin can change, we cannot guarantee that our information will always be up to engagement, so we encourage you lot to verify all the terms and conditions of any financial product earlier you apply.

Source: https://money.slickdeals.net/banking/sofi-bonus/

0 Response to "How To Transfer Money From Sofi To Cash App"

Post a Comment